Latest news

15 February 2024

Are you in control of your pension fund assets?

Have your pension fund assets kept up with all your job changes? Enquire at www.zentralstelle.ch - simply and free of charge.

Read more

9 February 2024

BVG Exchange accelerates data exchange between pension funds

The platform operated by the Substitute Occupational Benefit Institution simplifies the exchange of data on vested benefits among Swiss pension funds.

Read more

18 January 2024

Current delays in contacting Client Service

During the processing of your annual statements of account, the Client Service department will be available to you as follows.

Read more

29 December 2023

What changes will occur with the Reform AHV 21

In future, the so-called reference age will be standardised. What does this mean for our insured customers? And what is there to say about retirement for men and women? Find out more in this news.

Read more

9 December 2023

Interest rate and pension adjustments

The Substitute Occupational Benefit Institution is set to grant additional interest on retirement savings capital in the area of pension provision for 2023 under BVG/LPP. Moreover, interest rates have been set from 1 January 2024. Pensions will be adjusted for inflation in accordance with the law.

Read more

9 December 2023

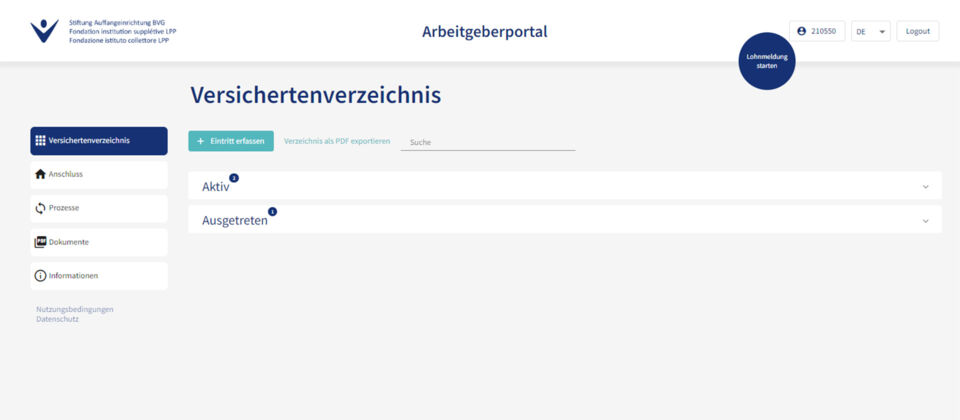

New employer’s portal: Process requests quickly and easily

Your new employer’s portal is online. You can now view, edit and export your employee information online and reduce your administrative tasks.

Read more

9 December 2023

Welcome to our new website!

In addition to the usual facilities such as online services, web forms or pension regulations, we now also offer you a comprehensive and informative career area.

Read more